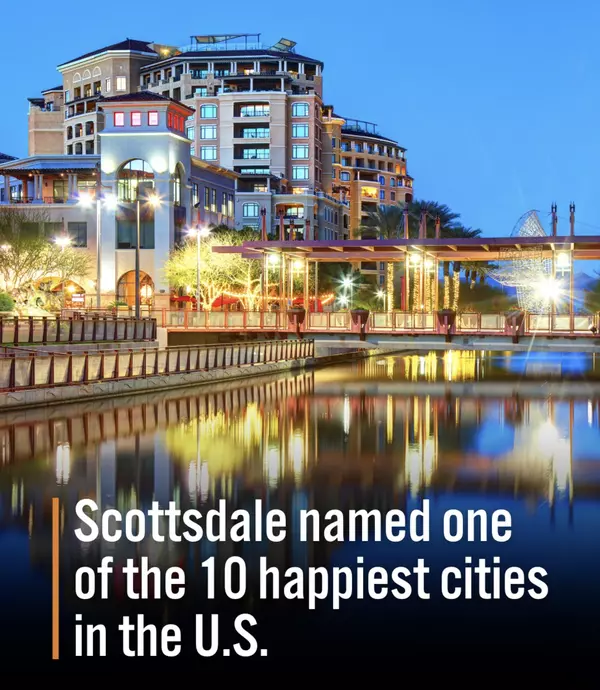

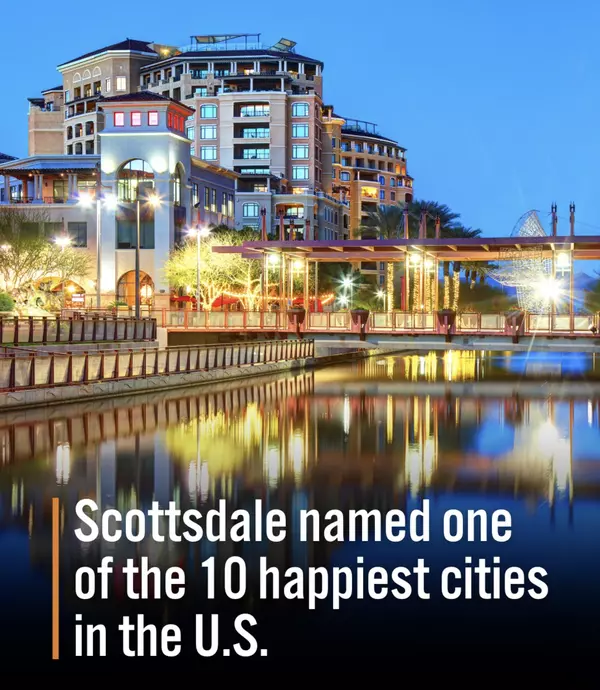

Scottsdale has recently been named one of the happiest places to live in the US

Here’s why: 1. Strong Economy & Job Market Scottsdale boasts a low unemployment rate, a strong job market, and high median household incomes. The city is home to thriving industries, including technology, tourism, healthcare, and finance. Scottsdale’s proximity to Phoenix provides even more caree

If you're a renter, your rent is going down next year. Here's why:

In 2023, Arizona passed a law that abolished rental tax. The law is not set to take place until January 1, 2025, to allow cities and towns to adjust to the loss of income. Because this is such a hotly contested issue and because it relies on landlord passing this savings on to residents, both tena

The Importance of Home Inspections: Protecting Your Investment in a New Home

What's a Home Inspection? Think of it as a thorough check-up for your potential new home. We hire a professional inspector to examine the property from top to bottom, looking for any structural or safety issues. This usually happens after you've made an offer but before closing the deal. Why it's

Categories

Recent Posts